st clair county tax map

Related Articles: st clair county tax map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to st clair county tax map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: st clair county tax map

- 2 Introduction

- 3 Unlocking the Secrets of St. Clair County: A Comprehensive Guide to the Tax Map

- 3.1 Understanding the St. Clair County Tax Map: A Visual Representation of Property Ownership

- 3.2 Accessing the St. Clair County Tax Map: Digital and Physical Options

- 3.3 The Importance of the St. Clair County Tax Map: Benefits and Applications

- 3.4 FAQs: Addressing Common Concerns and Questions

- 3.5 Tips for Effective Use of the St. Clair County Tax Map

- 3.6 Conclusion: A Powerful Tool for Understanding St. Clair County

- 4 Closure

Unlocking the Secrets of St. Clair County: A Comprehensive Guide to the Tax Map

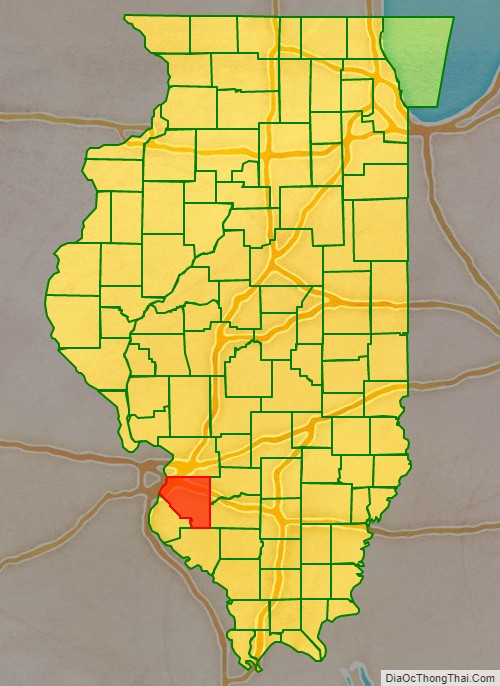

St. Clair County, Michigan, boasts a rich history and diverse landscape, drawing residents and visitors alike. However, navigating the intricacies of property ownership and taxation can be challenging. This is where the St. Clair County Tax Map emerges as an indispensable tool, offering a comprehensive and transparent view of property ownership and related information. This guide delves into the intricacies of this vital resource, explaining its significance, functionality, and potential applications.

Understanding the St. Clair County Tax Map: A Visual Representation of Property Ownership

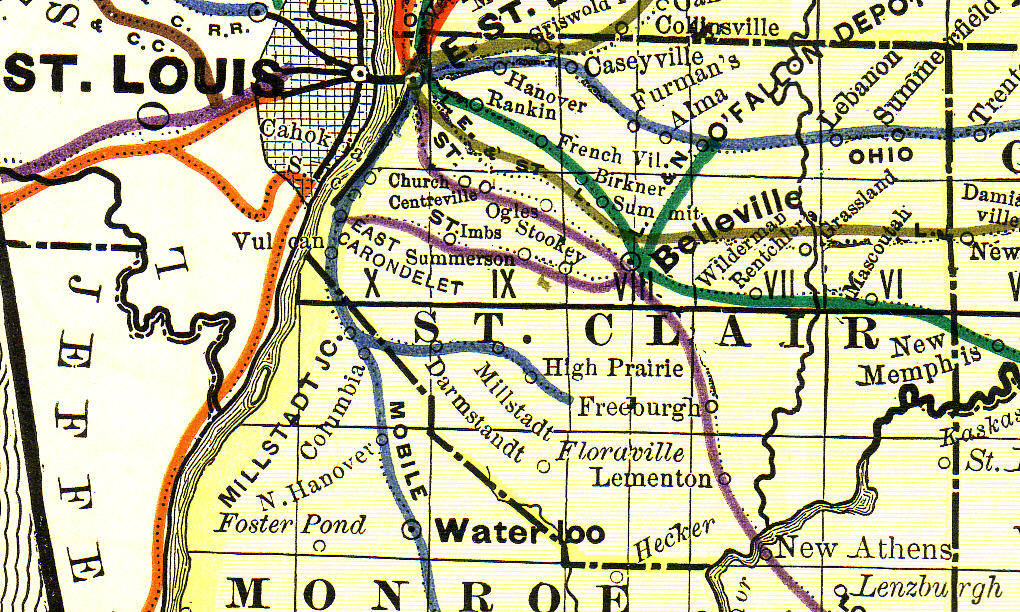

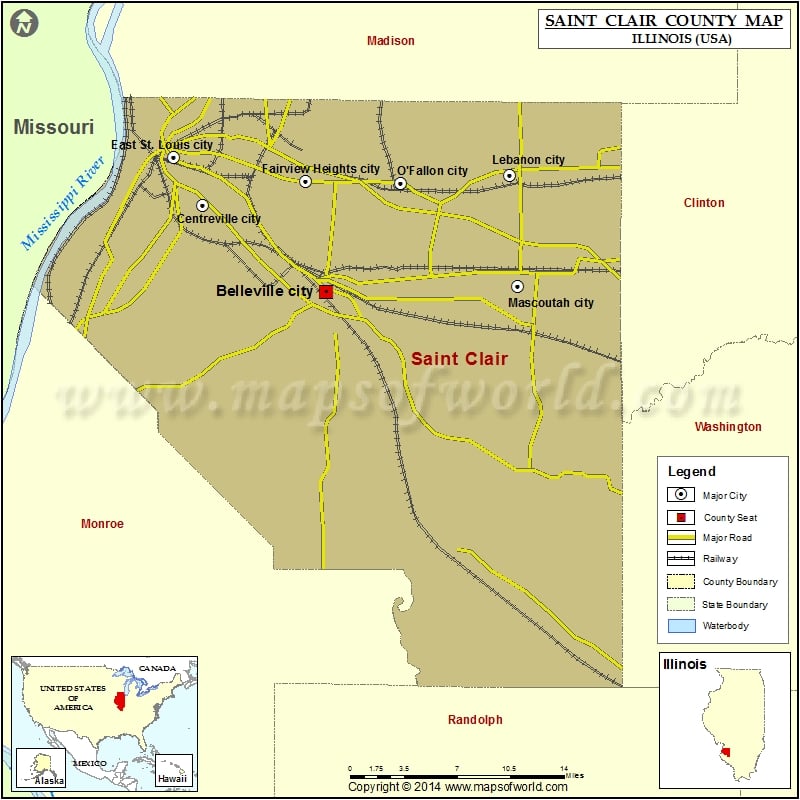

The St. Clair County Tax Map serves as a visual representation of property ownership within the county. It is a detailed, geographically accurate map that divides the county into distinct parcels, each assigned a unique identifier. This identifier, known as the parcel number, acts as a key to unlock a wealth of information about each property.

The map itself is typically presented as a series of digital layers, each representing a different aspect of property information. These layers may include:

- Property boundaries: Clear delineation of each individual parcel, allowing for accurate identification and measurement.

- Ownership information: Names and addresses of current property owners, providing crucial contact details for various purposes.

- Property classifications: Differentiation between residential, commercial, agricultural, and other land uses, helping to understand the intended purpose of each property.

- Tax assessments: Valuation of each property for tax purposes, enabling transparency in property taxation.

- Infrastructure details: Location of roads, utilities, and other essential infrastructure, offering valuable insights for planning and development.

Accessing the St. Clair County Tax Map: Digital and Physical Options

The St. Clair County Tax Map is readily accessible to the public through various channels, ensuring convenient access to property information.

Digital Access:

- St. Clair County website: The official website of St. Clair County typically provides a dedicated section for accessing the tax map, often with interactive features allowing for zooming, panning, and property searches.

- GIS platforms: Geographic Information Systems (GIS) platforms, such as ArcGIS Online, can host the tax map, offering advanced analysis and visualization capabilities.

- Third-party websites: Several third-party websites specialize in providing access to property records and maps, often offering additional features like property value estimates and neighborhood data.

Physical Access:

- County Assessor’s Office: The St. Clair County Assessor’s Office provides physical copies of the tax map, available for public inspection during business hours.

- Local libraries: Some local libraries may hold copies of the tax map, making it accessible to the community.

The Importance of the St. Clair County Tax Map: Benefits and Applications

The St. Clair County Tax Map serves as a vital resource for a wide range of stakeholders, offering numerous benefits and applications:

For Property Owners:

- Property identification: Accurate identification of property boundaries, ensuring clarity in ownership and legal matters.

- Tax assessment review: Understanding the basis for property valuation and potential avenues for challenging inaccurate assessments.

- Property value analysis: Assessing the market value of property, informing decisions related to buying, selling, or refinancing.

- Property development planning: Evaluating the feasibility of development projects, considering factors like zoning, utilities, and infrastructure.

For Real Estate Professionals:

- Property research: Efficiently identifying and evaluating properties for potential clients, streamlining the buying and selling process.

- Market analysis: Understanding property values, market trends, and neighborhood characteristics, informing pricing strategies and investment decisions.

- Due diligence: Conducting thorough research on properties, ensuring accurate information for clients and mitigating potential risks.

For Government Agencies:

- Tax administration: Accurately assessing properties for tax purposes, ensuring fair and equitable distribution of tax burdens.

- Land use planning: Identifying areas for development, conservation, or other land management initiatives.

- Emergency response: Locating properties and infrastructure for efficient response to emergencies and disaster situations.

For Community Members:

- Neighborhood awareness: Understanding the layout of neighborhoods, identifying local amenities, and discovering potential investment opportunities.

- Historical research: Tracing the history of property ownership and development, offering insights into the evolution of the county.

- Citizen engagement: Participating in community planning initiatives and advocating for responsible land use practices.

FAQs: Addressing Common Concerns and Questions

Q: How frequently is the St. Clair County Tax Map updated?

A: The St. Clair County Tax Map is typically updated annually, reflecting changes in property ownership, assessments, and other relevant data. However, specific update schedules may vary depending on the nature of the changes and the county’s internal procedures.

Q: Can I access the St. Clair County Tax Map for a specific property?

A: Yes, the tax map can be accessed for individual properties by searching for the specific parcel number. This number is usually found on property tax bills, deeds, or other official documents.

Q: What information can I find on the St. Clair County Tax Map?

A: The tax map typically provides information about property boundaries, ownership details, property classifications, tax assessments, and infrastructure location. The specific data available may vary depending on the platform used and the county’s data collection practices.

Q: Is the St. Clair County Tax Map accurate and reliable?

A: The St. Clair County Tax Map is generally considered accurate and reliable, as it is based on official records and updated regularly. However, it is essential to note that errors or discrepancies may occur due to human error or data inconsistencies.

Q: Can I use the St. Clair County Tax Map for legal purposes?

A: While the tax map provides valuable information, it should not be considered a substitute for official legal documents. Legal matters related to property ownership should always be addressed through consultation with qualified legal professionals.

Tips for Effective Use of the St. Clair County Tax Map

- Understand the map’s purpose: Clearly define your objectives for using the tax map to maximize its effectiveness.

- Utilize the search functions: Familiarize yourself with the search tools available on the chosen platform to efficiently locate specific properties or areas.

- Interpret the data correctly: Carefully review the information presented on the map, understanding the meaning of different symbols and layers.

- Cross-reference with other sources: Verify information obtained from the tax map with other reliable sources, such as property deeds or official records.

- Stay updated: Regularly check for updates to the tax map to ensure you are working with the most current information.

Conclusion: A Powerful Tool for Understanding St. Clair County

The St. Clair County Tax Map serves as a powerful tool for understanding property ownership, taxation, and related information within the county. Its accessibility, comprehensiveness, and accuracy make it an invaluable resource for property owners, real estate professionals, government agencies, and community members alike. By leveraging the insights provided by this map, stakeholders can make informed decisions, navigate property-related matters with confidence, and contribute to the responsible development of St. Clair County.

Closure

Thus, we hope this article has provided valuable insights into st clair county tax map. We thank you for taking the time to read this article. See you in our next article!