Unveiling the Land: A Comprehensive Guide to Jefferson County Tax Parcel Maps

Related Articles: Unveiling the Land: A Comprehensive Guide to Jefferson County Tax Parcel Maps

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unveiling the Land: A Comprehensive Guide to Jefferson County Tax Parcel Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Land: A Comprehensive Guide to Jefferson County Tax Parcel Maps

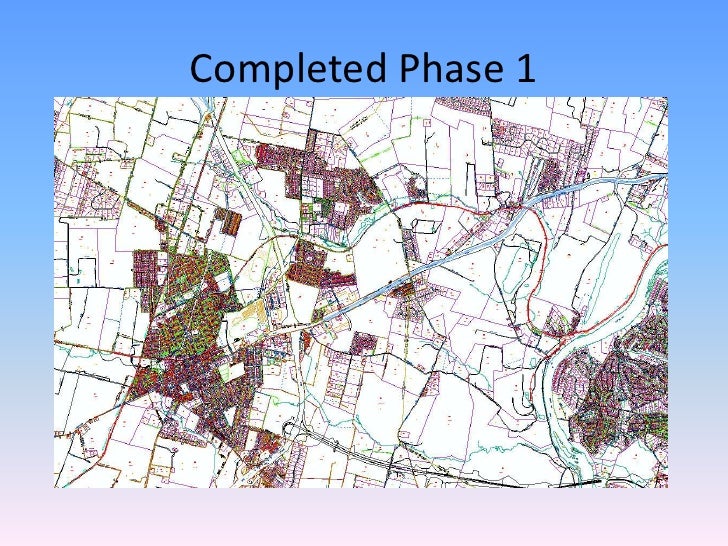

Jefferson County, like many other counties across the United States, relies on a system of tax parcel maps to manage and assess its vast real estate holdings. These maps, often referred to as property tax maps, serve as a fundamental tool for understanding the county’s land ownership, property values, and tax liabilities.

Understanding the Foundation: What are Tax Parcel Maps?

Tax parcel maps are detailed, geographically referenced diagrams that divide a county’s land into individual parcels, each assigned a unique identification number. Each parcel represents a specific property, be it a residential home, commercial building, vacant land, or even a portion of a larger property. These maps are not merely visual representations; they are comprehensive databases that store critical information about each parcel, including:

- Property Owner: The legal owner of the property is identified, providing essential information for tax assessment and communication purposes.

- Property Address: The official address of the property is recorded, ensuring accurate location identification and facilitating communication with residents or property owners.

- Property Boundaries: The exact boundaries of each parcel are meticulously outlined, defining the extent of the property and preventing disputes over ownership.

- Property Size and Dimensions: The area and dimensions of each parcel are recorded, providing crucial information for property valuation and development planning.

- Property Type: The type of property, whether residential, commercial, agricultural, or industrial, is specified, allowing for targeted tax assessment and planning.

- Property Value: The assessed value of the property is recorded, serving as the basis for calculating property taxes.

- Tax History: Past tax records, including payments and outstanding balances, are maintained, providing a clear history of property ownership and tax compliance.

Beyond the Basics: The Importance of Tax Parcel Maps

The importance of tax parcel maps extends far beyond the realm of property taxation. These maps serve as a vital resource for a wide range of stakeholders, including:

-

Government Agencies:

- Tax Assessors: Utilize the maps to determine property values for tax assessment purposes, ensuring fair and equitable taxation.

- Planning Departments: Rely on the maps to guide land use planning, zoning regulations, and development approvals, promoting responsible urban growth.

- Emergency Services: Use the maps to identify property locations quickly and efficiently during emergencies, enabling prompt and targeted response.

-

Real Estate Professionals:

- Realtors: Use the maps to determine property boundaries, identify neighboring properties, and assess potential development opportunities.

- Appraisers: Utilize the maps to gather information about property characteristics, aiding in accurate property valuations.

- Land Surveyors: Refer to the maps to verify property boundaries and ensure accurate surveying and mapping.

-

Property Owners:

- Homeowners: Can use the maps to verify their property boundaries, understand potential development restrictions, and access tax information.

- Landowners: Can use the maps to manage their property, track development activities, and understand potential tax liabilities.

-

Researchers and Developers:

- Historians: Can use the maps to trace property ownership patterns, understand land use changes over time, and reconstruct historical landscapes.

- Developers: Can use the maps to identify potential development sites, assess infrastructure needs, and understand zoning regulations.

Navigating the Maps: Accessing and Interpreting Tax Parcel Maps

Jefferson County, like many other counties, makes its tax parcel maps readily available to the public. The maps are typically accessible online through the county’s website or through dedicated mapping portals. These portals often provide interactive features, allowing users to zoom, pan, and search for specific parcels.

Interpreting the maps requires some basic understanding of mapping conventions. Each parcel is typically represented by a polygon, with the parcel number clearly displayed. The maps may also incorporate additional layers of information, such as zoning designations, road networks, and property features.

FAQs: Demystifying Tax Parcel Maps

1. How can I find my property on the Jefferson County tax parcel map?

You can access the Jefferson County tax parcel map online through the county’s website. The website will typically have a search function where you can enter your property address, parcel number, or owner name.

2. What information can I find on the tax parcel map?

The tax parcel map provides detailed information about each property, including the owner’s name, property address, boundaries, size, property type, assessed value, and tax history.

3. How are tax parcel maps used for property taxes?

The maps are used by the tax assessor to determine the value of each property, which is then used to calculate property taxes.

4. Can I use the tax parcel map to identify potential development sites?

Yes, the maps can help identify potential development sites by providing information about property boundaries, zoning regulations, and infrastructure availability.

5. Are tax parcel maps updated regularly?

Yes, the maps are typically updated regularly to reflect changes in property ownership, boundaries, and values.

Tips for Using Tax Parcel Maps Effectively

- Utilize the search function: The online map portal usually has a search function that allows you to quickly find your property by address, parcel number, or owner name.

- Explore the layers: Many mapping portals offer additional layers of information, such as zoning designations, road networks, and property features. Explore these layers to gain a more comprehensive understanding of your property and its surroundings.

- Check for updates: Tax parcel maps are frequently updated to reflect changes in property ownership, boundaries, and values. Be sure to check for the latest updates before making any decisions based on the information provided.

- Consult with professionals: If you need assistance interpreting the maps or have specific questions about your property, consult with a realtor, appraiser, or surveyor.

Conclusion: A Vital Resource for Understanding Land

Jefferson County’s tax parcel maps serve as a crucial resource for understanding the county’s land ownership, property values, and development potential. By providing a comprehensive and accessible database of property information, these maps facilitate efficient property taxation, informed land use planning, and informed decision-making for a wide range of stakeholders. Whether you are a homeowner, developer, or simply curious about your community, understanding the power of tax parcel maps can unlock valuable insights into the land around you.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Land: A Comprehensive Guide to Jefferson County Tax Parcel Maps. We thank you for taking the time to read this article. See you in our next article!